Virginia Insurance Requirements.

View Available Courses Here

Notice Regarding State Filing Fees

Effective February 1, 2021: Virginia Bureau of Insurance now requires a $2.60 per credit filing fee in order to submit your continuing education credits. This amount will be added in the shopping cart during checkout.

This information is intended to provide answers to commonly asked questions by insurance agents. It is not intended to replace detailed information found in your state’s statutes and regulations. Though we have made reasonable efforts to ensure that the information given is reliable and current, we cannot guarantee that it is. For more in-depth information regarding Virginia Insurance Continuing Education, please Click here to visit the Pearson VUE Virginia Insurance CE website.

Resident and non-resident agents or consultants who hold one or more of the following lines or qualifications must meet the Virginia CE requirements: - Life & Annuities, Health, Life & Health Consultant, Property & Casualty, Property & Casualty Consultant, Personal Lines, Title, Public Adjusters.

*Special Notice Regarding Annuity Suitability - Effective September 1, 2021*

- Agents licensed prior to September 1, 2021 who sell annuities in Virginia must complete a onetime one-hour course which includes the best interest standard by March 1, 2022.

- Agents licensed on/after September 1, 2021, must complete a one-time four-hour course which includes the best interest standard prior to engaging in the sale of annuities in Virginia.

- Starting September 1, 2021, licensees can lookup available courses at www.sircon.com/virginia. Insurers are responsible for verifying that an agent selling an annuity product in Virginia on their behalf, on or after September 1, 2021, has completed the requisite Annuity Suitability Best Interest training. (See 14 VAC 5-45-45 B 11 of the Virginia Administrative Code.)

- When does the new Annuity Suitability Best Interest training requirement become effective?

The new requirement was adopted September 1, 2021 and is effective March 1, 2022.

- Who must take this training?

All resident producers who engage in the sale, solicitation, or negotiation of annuity products, and those non-residents who have not completed substantially similar training including the Best Interest standard in another state must complete a Virginia approved course.

NOTE: Annuity Suitability credits are only applicable to a Life Only or Life/Health license. They are not applicable to a Health Only license.

IMPORTANT - CONTINUING EDUCATION CHANGES EFFECTIVE 1-1-2021

License(s) will have an expiration date based on your birth month and odd/even year of birth. For example, if you were born in an odd-numbered year, your license will expire at the end of your birth month in odd-numbered years. If you were born in an even-numbered year, your license will expire at the end of your birth month in even-numbered years.

- If you are licensed on or before 1/1/2021, you will have a minimum of 13 months to complete your CE before your first renewal.

- If you are licensed after 1/1/2021, you will have a minimum of 13 months from the date your license was issued to meet your CE requirements.

- There will no longer be a continuance fee; however, there will be a $10 fee per line of authority to renew your license.

- You must complete the required number of credits by your license renewal date.

- If you fail to renew your license on time, you have 12 months to reinstate your license by completing CE and submitting a reinstatement application.

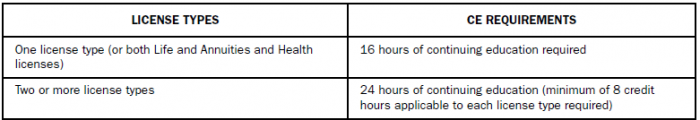

Hours Required

-Public Adjusters - 24 hours of approved CE Courses, including 3 hours of ethics (Please note that : ILR will not fall under the Ethics Category for Public Adjusters, the course must be "Ethics") and the remaining 21 hours in any combination of the following courses (Please note that : OGI does not fall under the additional 21 hours as being acceptable for Public Adjuster credits):

- Property and Casualty Courses

- Mitigation Courses

- Flood Courses

- Public Adjuster Courses

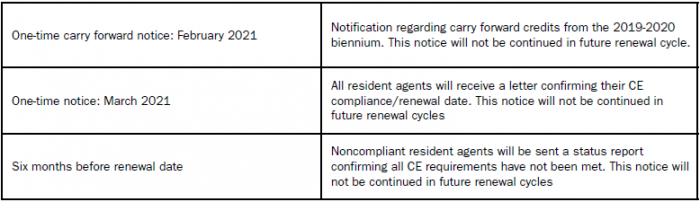

Compliance Date

License(s) will have an expiration date based on your birth month and odd/even year of birth. For example, if you were born in an odd-numbered year, your license will expire at the end of your birth month in odd-numbered years. If you were born in an even-numbered year, your license will expire at the end of your birth month in even-numbered years.

Your CE is aligned with your license expiration date. This date is calculated based on the end of your birth month in odd/even year of birth. If your license expires within 13 months of issuance, that license is not subject to CE; however, you must still submit a renewal application. CE will be due two years from the date you renew your license.

Approved Course Delivery Methods

• Independent self-study online or written courses (passing grade of 70% required on final exam)

• Classroom

• Interactive Online

• Seminar (only 75% of the requirement may be earned from company and/or agency sponsored courses)

Exam Requirements

Effective June 7, 2016 - Virginia Insurance CE final exams administered online no longer require a proctor/monitor.

Self-study examinations which are not administered online must be proctored in a manner approved by Pearson VUE. The proctoring process must ensure the examination will be completed by the student, on a closed-book basis, without assistance. The proctor must be over the age of 18 years and unrelated to the student. The following may proctor the examination:

• Librarian at a public library

• Lawyer

• Corporate Training Department

• Supervisor

• Instructor

• Approved test administration service

• Human Resources or Education Department Personnel

• Local Course Provider

• Office Manager

• Person with a professional insurance designation such as, but not limited to a CPCU designation

• A person in any supervisory position to the agent

• Personnel at a local school (i.e., Guidance counselor, professor or teacher, clergy)

A proctor CANNOT be a relative, friend, or an acquaintance. The proctor must be a disinterested party over the age of 18 years and unrelated to the agent.

The list of acceptable proctors has been greatly expanded by Pearson VUE. You may visit the following website for more information: VA Insurance CE Handbook

Course Subject Requirements

• At least 3 hours must be in Ethics

• At least 8 hours must be relevant to each license type if 24 hours is required.

• All hours must be relevant to license type held if 16 credit hours is required.

• For producers who sell LTC an initial 8-hour course is required in order to sell LTC Partnership policies, thereafter a 4-hour course must be completed every two years from that date. It is the employer's responsibility to verify that this requirement is met by the agent within each twenty-four month period, not each license CE biennium. Please see the following administrative letter for more information: http://www.scc.virginia.gov/boi/index.aspx

• For producers who sell Flood insurance they must complete at least a 3-hour course in flood insurance. Please see the following administrative letter for more information: http://www.scc.virginia.gov/boi.index.aspx

• For producers who wish to sell Annuities, a one time 4-credit training course approved for Annuity credits must be completed.

-Public Adjusters must complete 3 hours ethics and 21 hours in any combination of the following courses: Property & Casualty courses, Mitigation courses, Flood courses, and Public Adjuster courses.

Carryover Credits

• Excess credit hours accumulated during any renewal cycle may be carried forward to the next renewal cycle only.

• Excess CE credits will not be carried over if you fail to renew your license during the 90-day renewal period.

Course Repetition

Courses may not be taken more than once within the same reporting period

Exemptions

• Individuals who hold a limited line license, such as credit life/health, travel accident and travel baggage insurance agents.

• Non-resident agents if their home state has CE requirements and has a reciprocal agreement with Virginia.

• Military Exemption: Agents who are military reservists called to active duty for more than 30 days may be eligible for a waiver for all or a part of their CE requirement.

- As of January 1, 2019 Virginia will no longer offer exemption from continuing education requirements due to age and length of licensure. Insurance agents granted exemption prior to this date will remain valid unless and until their licenses are otherwise terminated.

See the Handbook for details for requesting a waiver. Requests must be supported by documentation and will be reviewed on a case-by-case basis.

Credit Reporting

Cape will report all CE credits to Sircon within 10 days. A certificate of completion will be provided for your records.

License Renewal and Information

Visit the Virginia Bureau of Insurance Producer Assistance Page to renew or look up your license number, pay fees, and more

http://www.scc.virginia.gov/boi/index.aspx

Check your resident and non-resident license status and license number look up: http://www.sircon.com/index.html

Pre-Licensing Information:

According to the Agents Licensing Section of the Commonwealth of Virginia, all applicants for insurance licensing in Virginia should now upload all attachments and submit them with the electronic application using Sircon's Compliance Express ("CX"). The new functionality for electronically submitting the Virginia Criminal History Record Report (CHRR) is the most efficient and secure way for the Bureau to receive and process license applications. Visit www.scc.virginia.gov/boi for licensing information and http://www.sircon.com/virginia to apply online. To attach the CHRR and related documents go to the License Application Confirmation Page or the License Application Activity Inquiry and use the Attach Supporting Documentation button (a paperclip icon). There you can browse for the electronic document on your computer, provide a description and upload the document to the license application.

Contact Information:

If you have any questions regarding renewal or credits, please contact:

Sircon: 877-876-4430 or www.sircon.com

Virginia Bureau of Insurance

Agent Licensing Section

P.O. Box 1157

Richmond, VA 23218

(804) 371-9741

https://www.scc.virginia.gov/boi/pro/index.aspx

Contact Cape:

Cape School, Inc.

P.O. Box 169

Buckingham, VA 23921

Phone: 800-729-7363

Fax: 888-303-1828

Or email us: info@capeschool.com

Have Questions? Call us at # 800-729-7363 or reach us by email at info@capeschool.com.